Now

is the "time to sell"

Since 2014, Japanese are the top foreigners who purchase Hawaii real estate. In Hawaii, more than 2,000 units have been purchased by the Japanese in the last 5 years. Villas, investment, tax savings, and needs vary, but it is undeniable that the Japanese buyer continues to increase rise in Hawaii.

This is the trend showing that many Japanese investors have purchased new developments such as Ritz-Carlton, Ward Village, etc. starting with One Ala Moana.

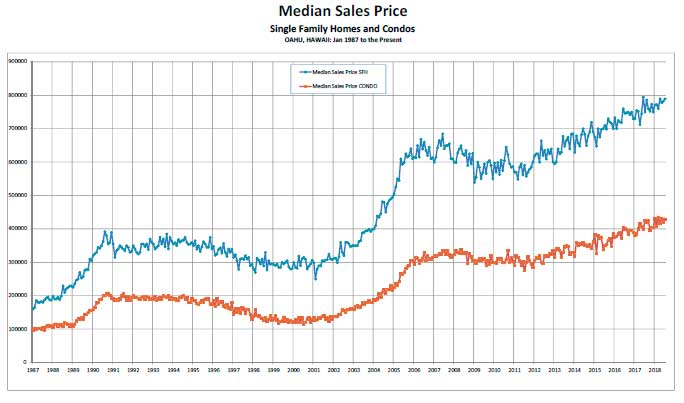

Data Source: Honolulu Board of Realtors

Above shows the history of the Oahu housing market median price range over the past 30 years. The Blue line is single-family homes and Orange are condominiums.

After the Lehman shock in 2008, the gradual downward trend has been changing from around 2013 to an upward trend. Considering that the sales of One Ala Moana began in December 2012, it also coincides with the time when Japanese investors started buying Hawaii. Just as the second Abe cabinet is inaugurated, it also coincides with the time when the stock price rose by Abenomics.

It is also around 2013 that investment in townhouses purchased for tax saving began to increase. In 2014, the sale of the Ilikai hotel renovation project, it goes without saying that this movement was further accelerated.

Update

record high in August 2018

Hawaii real estate continued to be on the

upward trend, but recently the median price for single-family homes reached a

historical high in August. The median price for single-family homes is 810,000

dollars, a 3.0% rise compared to the same period last year. Condominiums also

performed well, with a median price of $ 427,000, 1.9% higher than the same

period last year. Analysts of major real estate companies say this upward trend

will continue.

Japanese

investors start selling from 2019

So why now is the time to sell?

Japanese investors who have acquired Hawaii real estate in 2013 will have had their property for six years in January 2019. In other words, it will be the time to switch from short-term to long-term in individual transfer income tax in Japan, which tax will be almost half, it is a good time to consider selling. Especially for those who purchased wooden structure townhouses for tax savings in depreciation, the building already has used up its depreciation and it is better to switch properties by selling earlier.

Naturally, if the number of properties for sale increased, inventory will increase temporarily, there is a possibility that the upwardly priced property price will be affected. Of course, I’d like to avoid that.

In other words, as the prices are on an upward trend, there is still a lot of demand, it is a good time to sell.

Sell fast if it’sluxury property

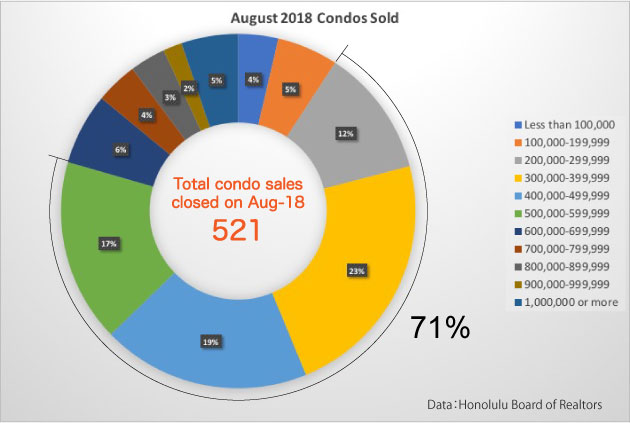

It is a healthy Hawaii real estate market, but what about price points?

Of the 521 transactions settled in August, in fact more than 70% are concentrated in the price range from 200,000 dollars to less than 600,000 dollars. The property in this price range, the DOM is also extremely short, and the demand is greatly exceeding supply.

At the same time, however, the higher the price, the fewer the close number is. Of course, it is natural that the demand for condos with a high price point is relatively small.

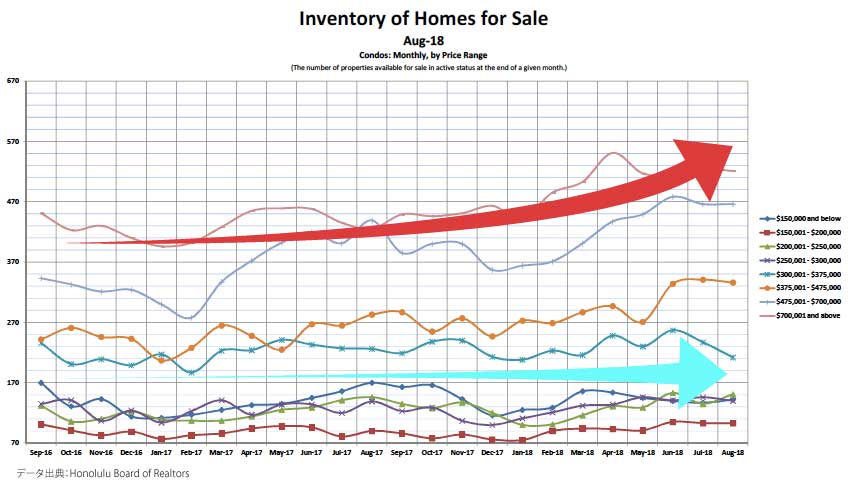

Below is a graph showing the housing inventory on the market by price point. You can see that the inventory is low for condos under $ 375,000. However, there seems to be a gradual increase in the number of properties with a price over $ 475,000.

Although it is a booming Hawaii real estate market, the supply is higher than the demand the higher the price point.

Now is the time to sell especially if you have a high valued property.

Let us help you sell. Just send us your name and property address. We will send an estimate report to you.